Check out our frequently asked questions, which we’ve grouped together here to provide you with answers. Contact us today if you have any other questions at 1-844-214-1895 or by email at [email protected]

The variable credit agreement is the contract by which a credit is granted in advance by a merchant to a consumer who may avail himself of it from time to time, in whole or in part, according to the terms of the contract.

The variable credit agreement includes the contract for the use of what is commonly referred to as a credit card, credit account, budget account, revolving credit, line of credit, line of credit and any other similar contract.

I am paid by check. Am I eligible?

Unfortunately, no. We require that your pay be deposited by direct deposit in your bank account.

Many stores offer the use of their fax for a small payment. You can find them in the following locations:

- Office Depot

- Post Office

- Pharmacy

- Corner Store

- Your Employer

- Library

- Photocopy Centre

We only accept applicants who receive a salary by direct deposit.

You can apply for a Credit Margin online thanks to our application form. You can also call us at 1-844-214-1895 or write us at [email protected]

- You are 18 years or older

- You have a stable salary of $1200/month or more

- You have been employed for more than 3 months

- You are a Canadian resident

- You are paid by direct deposit in a Canadian bank account

- You don’t have excessive bad payments in your account

- You don’t have an overly high level of short term debts

- You are under a consumer proposal or voluntary deposit

- You have unstable work

- You have supplied incomplete required documents or erroneous information

If the transfer was completed before 10:30am, you should receive your Credit Margin before the end of the day. However, if the transfer was completed after 10:30am, you may face a 24 hour delay before you receive your money or Credit Margin in your bank account.

Yes, we accept clients that are part of the above programs. Certain conditions may apply; talk with us today to learn more.

Credit Margin companies that we work with offer:

- An annual interest rate of 22% (APR);

In cases of payment default or non-cooperation, the debt will be sent to a collections agency.

The Instant Banking Verification (I.B.V.) is the most recent technology used by banking institutions. It provides a read-only version of your bank statement and confirms your information. Thanks to this new system, there is no need to send us documents we can approve your Credit Margin request even faster!

The I.B.V. is the most secure technology on the market. It’s an equal level of security as what is used in the largest Canadian banks. This will never give us access to your password or username. All information provided along with your bank statement is kept confidential and will never be shared as mentioned in the variable credit contract.

No, never! We will never have access to see your username and password. The IBV allows us to only view your bank statement.

This is the paperless application; we will not need your documents if you do the I.B.V. However, there are some exceptions to this rule for more information please contact our customer service at 1-844-214-1895.

This option allows you to complete your application without the hassle of sending your documents. The IBV has an equal level of security as what is used in the largest financial institutions.

It’s easy! you can contact your financial institution and ask them to create your online credentials. Once you have a username and password, it will be important to first log in to your account before the I.B.V.

OR

You can choose to apply manually. To do so, you will need to provide us your signed contracts as well as the following documents:

- Your last 30 days bank statement

- Your last pay slip

- A proof of identity

- A proof of residency

- A void cheque

A photo ID is a legal document issued by the government of Quebec or Canada. Examples of valid photo IDs are:

- Driver’s license;

- Provincial health card;

- Valid passport.

A pay stub if a note or document given to you by your employer at the same time as your pay. It can be given to you with your check or sent by email if you have direct deposit.

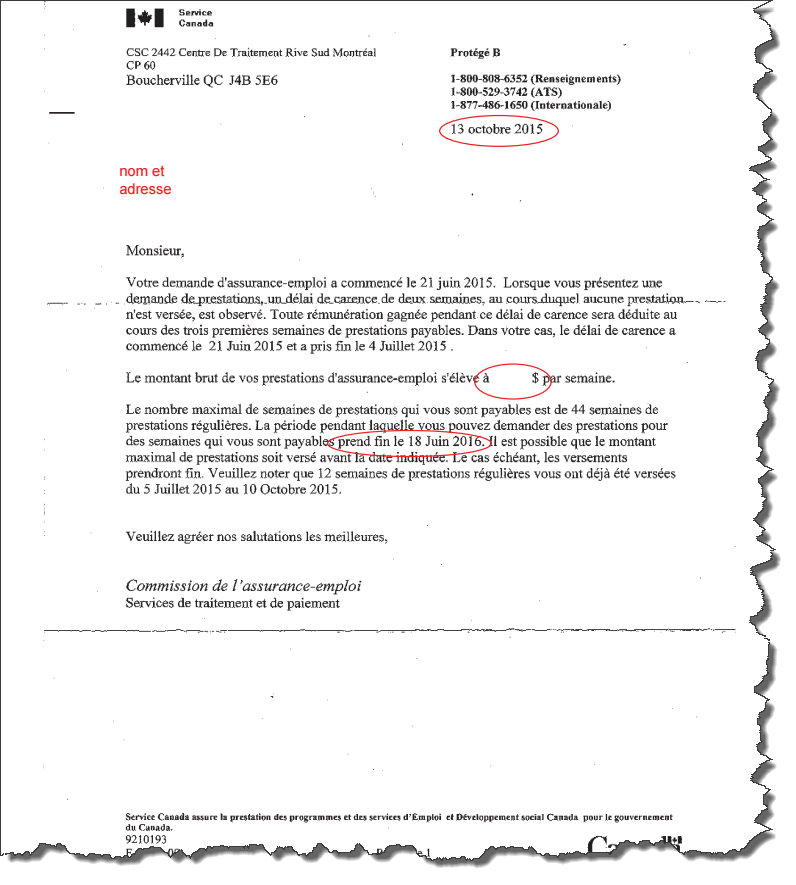

Here is an example of an Employment Insurance form. The 2 following documents replace a pay stub.

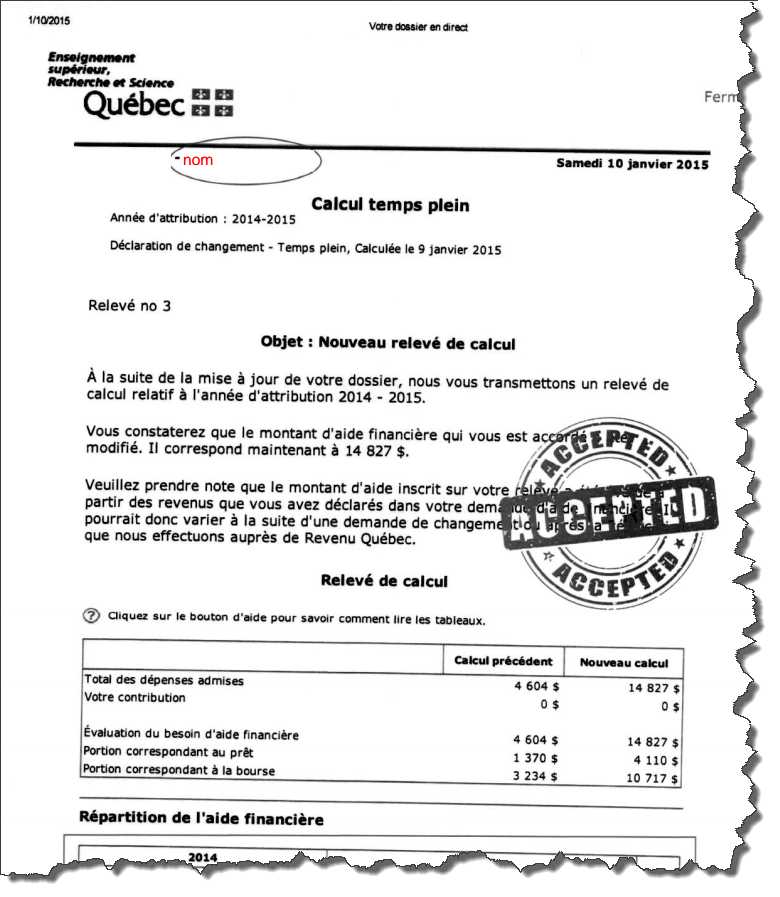

Here is an example of an assessment statement for a student loan.

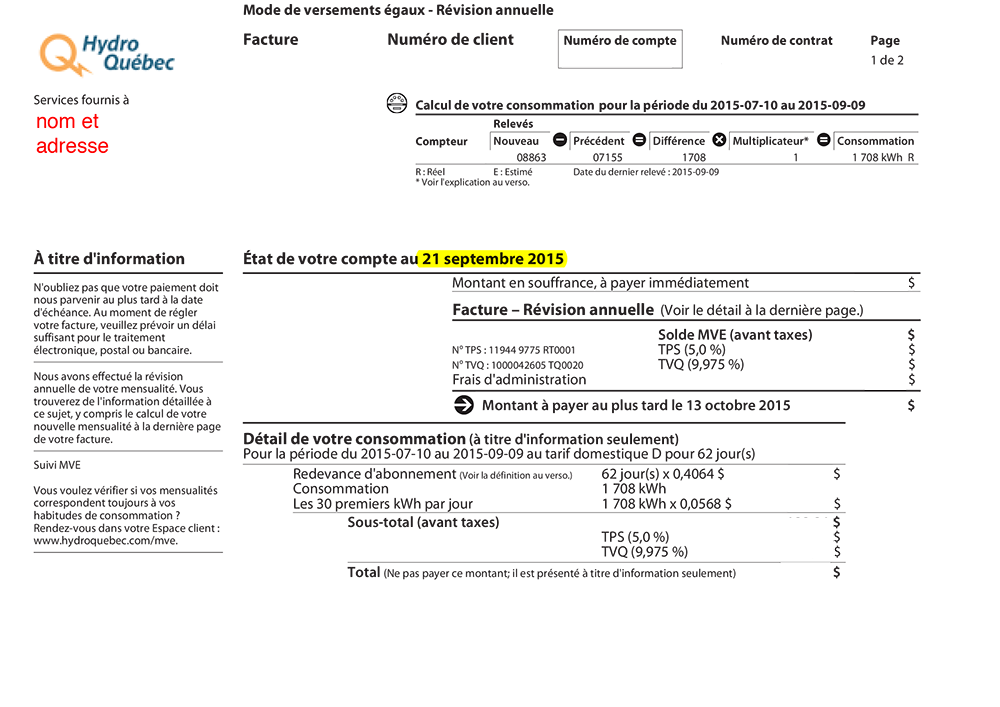

Proof of residence is required to confirm that the address on your Credit Margin application is where you live. An utility bill or a phone bill are two examples or a proof of residence.

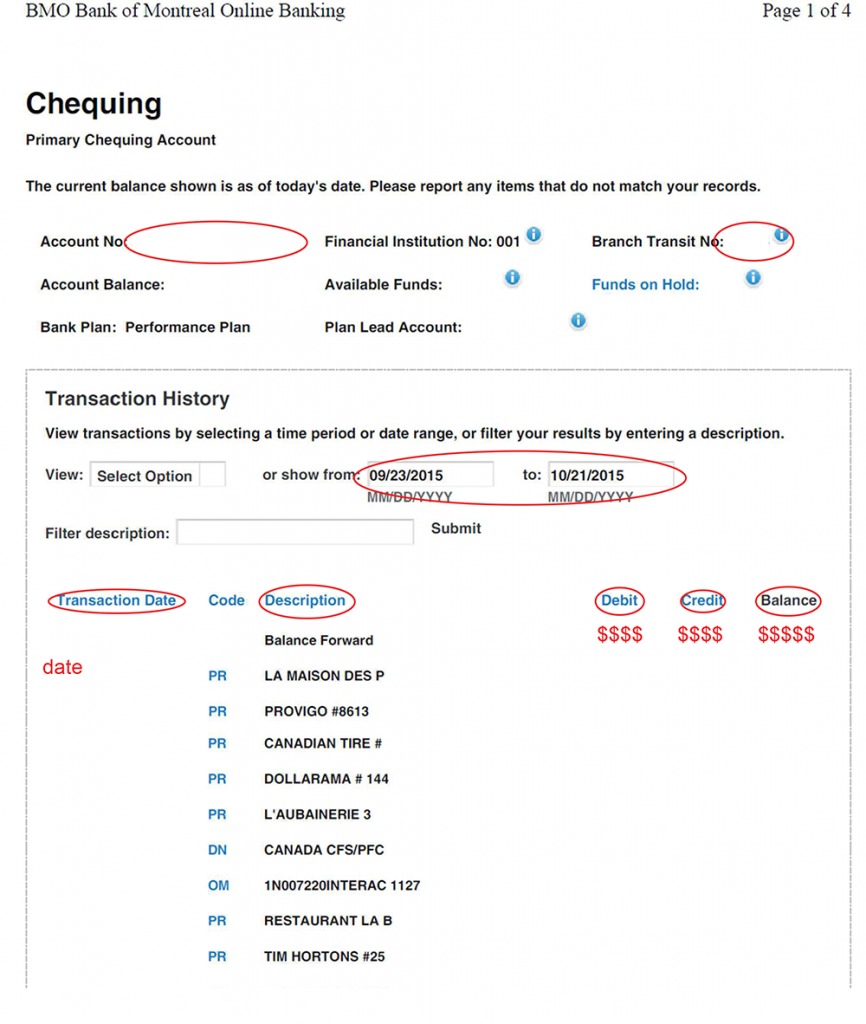

A bank statement is a document presenting every transaction in a bank account for the last 30 days. This document is often sent by mail or is accessible online depending on your financial institution. Super Prêt requires a bank statement from the account where you receive your pay, often called “checking account”.

Here is an example of Q.P.I.P. stub.

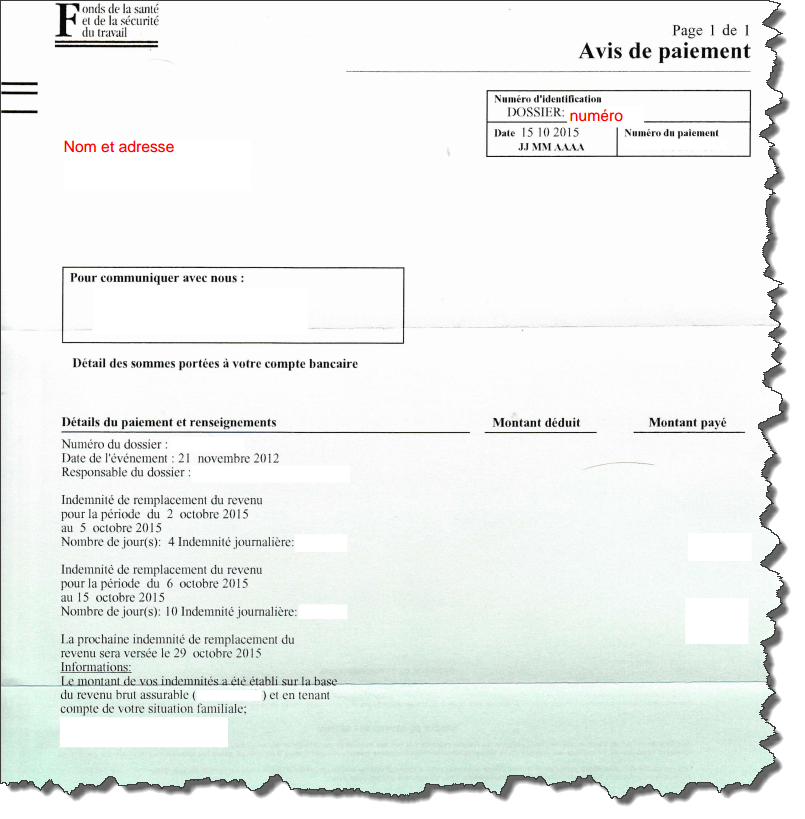

Formerly known as C.S.S.T. Here is an example of a C.N.E.S.S.T. form. This form is provided by the Commission des Normes, de l’Équité, de la Santé et de la Sécurité du Travail

Please note that this form is only available in french. Feel free to call us 1-888-374-5777 for assistance.

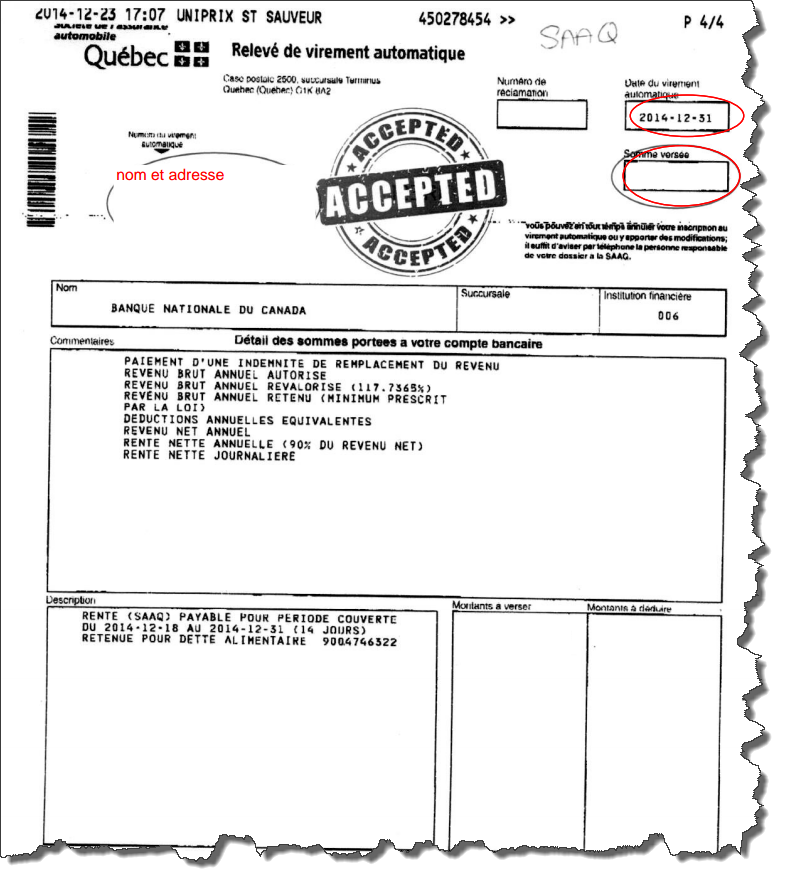

Here is an exemple of an SAAQ stub.

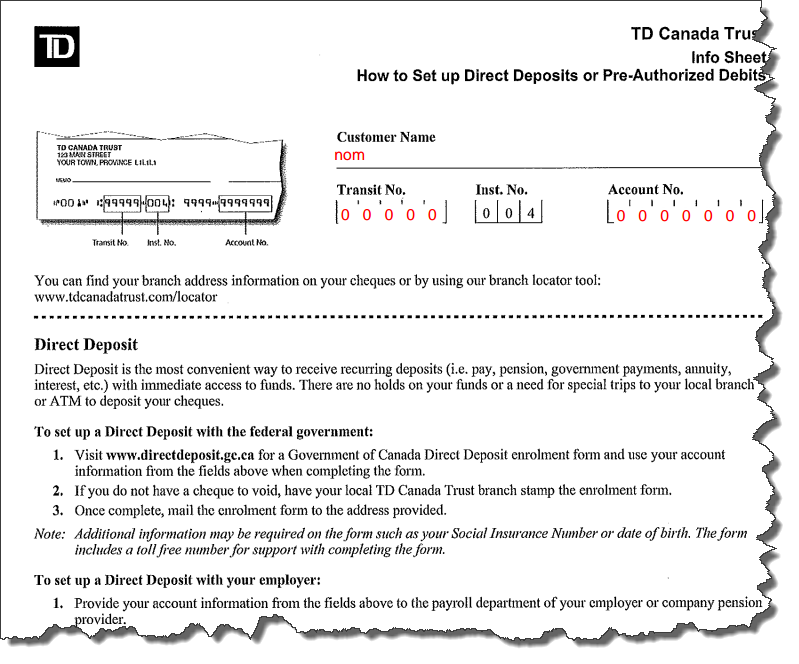

A blank check is a voided check that you provide to a financial service such as Super Prêt or to an employer in order to receive direct deposit. The blank check requested by Super Prêt is one associated with the bank statement provided during the application process. Please note that Pre-Authorized Deposit Form are also accepted.